Fall 2019

Impact Update

As we enter our 37th year, the Community Foundation has evolved from our modest beginnings to become a center for solutions across Santa Cruz County. With almost $130 million in total assets, we have the resources to help charitable visions get established and grow, improve the effectiveness of the more than 500 local nonprofits we serve, and continue to build on our $90 million in grantmaking efforts.

Grants Fuel Impact Countywide

Borina Special Places Fund supports historic, youth, and senior facilities. Because of the generosity of the Borina family, in 2019 we awarded close to $400,000 for capital projects that gave youth places to develop, seniors places to gather, and that served to preserve the unique history of the county.

Flexible grants reward effective nonprofits. In 2018, we created a new, simple and easy grant process to help nonprofits keep their focus on mission – not paperwork. This year we were also pleased to provide over $700,000 in flexible support for ongoing operations to our county’s essential service providers.

Collaborative funding approach benefits the arts ecosystem. To help our arts organizations create art for audiences across the county, we partnered with the Arts Council to make a single application and award process. Together, we have successfully funded almost $500,000 dollars in needed resources for our vibrant arts community.

Our Loans Make It Possible

Our Community Investment Revolving Fund provides local low interest loans to the tune of $3.2 million to six local projects. These funds are already at work creating housing, growing income, and expanding sustainable agriculture.

For example:

- Homeless Services Center is building 6 apartments for people transitioning out of temporary shelter.

- Habitat for Humanity is adding 11 new affordable homes in Live Oak.

- FarmLink is helping farmers expand their sustainable agriculture businesses.

- Landed has helped 18 teachers buy their first homes.

Donors are invited to co-invest in our Community Investment Revolving Loan Fund to put local capital at work for local solutions.

By the Numbers

Inspiring: $90 million in local grants since 1982

Record breaking: $11.7 million awarded in 2018

Prudent: 8.3% average 10 year rate of return

Trusted: $128 million in assets at year end 2018

Forward thinking: 250 Endowed Funds

Efficient: Operating budget is 2% of total assets

Why Us?

We asked our members why they turned to the Foundation for help with their philanthropy. Here are some of the things they said:

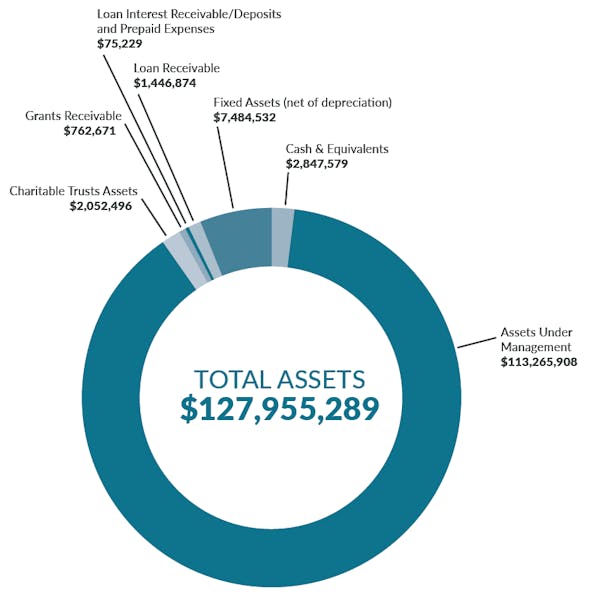

STATEMENT OF FINANCIAL POSITION

Fiscal Year Ending December 31, 2018

ASSETS

Cash & Equivalents $2,847,579

Investments at Fair Market Value $113,265,908

Charitable Trusts Assets $2,052,496

Grants Receivable $762,671

Loan Receivable $1,466,874

Deposits and Prepaid Expenses $75,229

Fixed Assets (net of depreciation) $7,484,532

TOTAL ASSETS $127,955,289

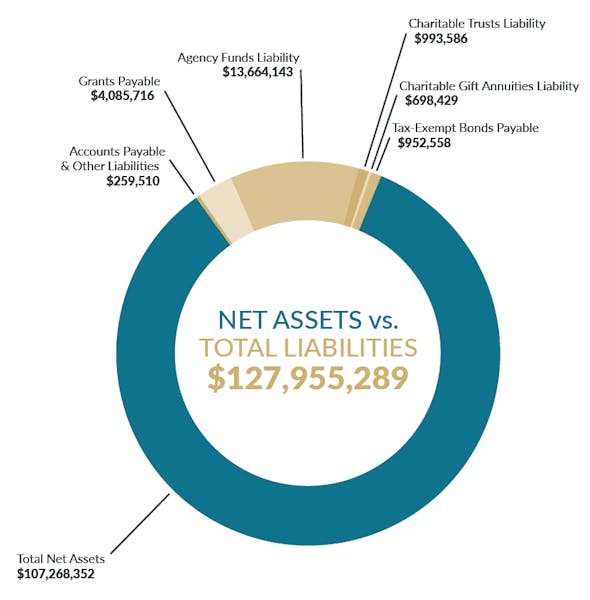

LIABILITIES

Accounts Payable & Other Liabilities $259,510

Grants Payable $4,085,716

Agency Funds Liability $ 13,664,143

Charitable Trusts Liability $993,586

Charitable Gift Annuities Liability $ 698,429

Tax-Exempt Bonds Payable $952,558

TOTAL LIABILITIES $20,686,937

TOTAL NET ASSETS $107,268,352

TOTAL LIABILITIES & NET ASSETS $127,955,289

Join the giving community in Santa Cruz County. Let's chat about where you want to put your generosity to work.