Charitable Gift Annuity (CGA)

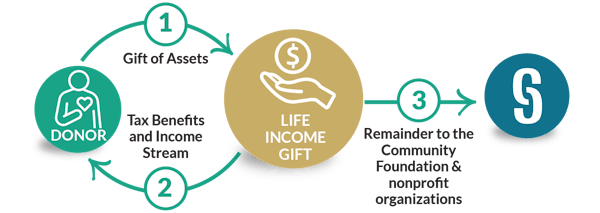

A charitable gift annuity (CGA) is a contract where you transfer cash, securities or other assets to Community Foundation Santa Cruz County in exchange for a fixed annual income for life. The minimum funding amount to establish a CGA is $25,000. Your gift will support the Community Foundation, and any other nonprofit endowed funds we hold at the end of the contract.

Assets that work well for CGAs:

- Cash

- Appreciated securities

- IRA assets (for those over age 70 1/2, restrictions apply)

Benefits:

Charitable Gift:

- Support the Community Foundation and any of our nonprofit endowed funds to address the needs of Santa Cruz County in perpetuity.

Tax Benefits:

- Income tax charitable deduction at the time of the gift if established with cash, securities, or property.

- Taxpayers 70 ½ or older can use a one-time qualified charitable distribution (QCD) to fund a charitable gift annuity (CGA).

Life Income Payments:

- Fixed payments for life for you and/or another beneficiary.

- Option to delay the initial payment for one or more years as a retirement planning solution.

Note: To begin receiving payments, the income recipient must be at least 60 years of age. Below are the American Council on Gift Annuities (ACGA) Single Life Annuity rates for 2025.

Example:

"Mercedes, a supporter of local nonprofits, at age 70 decides to create a charitable gift annuity by contributing $100,000 from her investment portfolio. In return, she receives a 6.3% payout, which amounts to $6,300 annually for the rest of her life. Additionally, Mercedes gets a charitable income deduction of approximately $38,421.00 in the year of her gift."

This arrangement not only enhances her financial future, but also enables her to make a lasting impact on the community she loves. Upon her passing, any remaining funds from her annuity will be directed to the Community Foundation and can support our nonprofit partners.